Not known Facts About Top 30 Forex Brokers

Little Known Questions About Top 30 Forex Brokers.

Table of ContentsGetting My Top 30 Forex Brokers To WorkThe smart Trick of Top 30 Forex Brokers That Nobody is Talking AboutThe Definitive Guide to Top 30 Forex BrokersSee This Report on Top 30 Forex BrokersTop 30 Forex Brokers - TruthsNot known Facts About Top 30 Forex BrokersTop 30 Forex Brokers Things To Know Before You Get ThisTop 30 Forex Brokers Fundamentals Explained

Like various other circumstances in which they are used, bar charts give even more cost info than line graphes. Each bar chart represents one day of trading and contains the opening price, greatest price, most affordable price, and closing price (OHLC) for a profession. A dashboard on the left stands for the day's opening cost, and a similar one on the right represents the closing price.Bar graphes for currency trading aid traders recognize whether it is a buyer's or vendor's market. Japanese rice traders initially utilized candle holder graphes in the 18th century. They are visually much more enticing and much easier to read than the graph types defined above. The upper section of a candle is used for the opening cost and greatest cost point of a money, while the reduced part shows the closing rate and lowest price factor.

The 30-Second Trick For Top 30 Forex Brokers

The formations and forms in candlestick charts are utilized to recognize market direction and motion. Some of the much more usual developments for candlestick graphes are hanging male - https://fliphtml5.com/homepage/irinv and shooting celebrity. Pros Largest in regards to everyday trading volume in the globe Traded 24 hours a day, five and a fifty percent days a week Beginning resources can quickly increase Usually follows the very same regulations as normal trading A lot more decentralized than conventional supply or bond markets Tricks Utilize can make forex trades extremely unpredictable Utilize in the array of 50:1 prevails Requires an understanding of economic fundamentals and indicators Much less law than other markets No earnings producing instruments Foreign exchange markets are the largest in regards to day-to-day trading quantity around the world and for that reason provide the most liquidity.

Banks, brokers, and dealerships in the foreign exchange markets permit a high quantity of utilize, implying traders can manage big placements with fairly little money. Leverage in the series of 50:1 prevails in forex, though even greater quantities of take advantage of are offered from specific brokers. Nevertheless, utilize must be used meticulously since lots of unskilled investors have experienced substantial losses utilizing more utilize than was needed or sensible.

Top 30 Forex Brokers - Questions

A currency investor requires to have a big-picture understanding of the economic climates of the various countries and their interconnectedness to understand the basics that drive currency values. Get the facts The decentralized nature of foreign exchange markets indicates it is less controlled than other financial markets. The extent and nature of policy in foreign exchange markets depend on the trading jurisdiction.

Forex markets are among one of the most fluid markets worldwide. They can be much less unpredictable than other markets, such as real estate. The volatility of a particular currency is a feature of several variables, such as the politics and economics of its country. For that reason, occasions like economic instability in the type of a payment default or discrepancy in trading relationships with one more currency can result in considerable volatility.

The 45-Second Trick For Top 30 Forex Brokers

Money with high liquidity have a prepared market and exhibit smooth and foreseeable cost activity in feedback to external events. The United state buck is the most traded currency in the world.

Top 30 Forex Brokers Fundamentals Explained

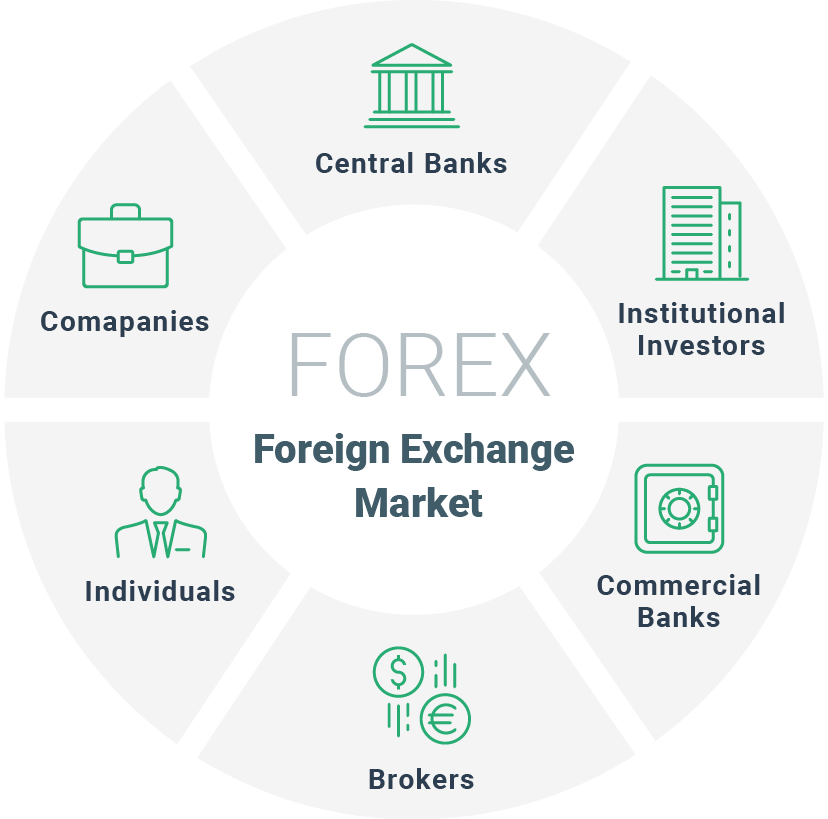

In today's info superhighway the Forex market is no much longer only for the institutional capitalist. The last 10 years have actually seen an increase in non-institutional investors accessing the Foreign exchange market and the advantages it uses.

Not known Details About Top 30 Forex Brokers

International exchange trading (foreign exchange trading) is a global market for purchasing and selling money - icmarkets. 6 trillion, it is 25 times larger than all the world's stock markets. As an outcome, prices change frequently for the money that Americans are most likely to make use of.

When you market your currency, you receive the settlement in a various currency. Every traveler that has actually gotten foreign money has actually done foreign exchange trading. The trader buys a particular money at the buy cost from the market maker and sells a various currency at the marketing cost.

This is the transaction price to the investor, which in turn is the earnings made by the market maker. You paid this spread without realizing it when you exchanged your dollars for international currency. You would notice it if you made the transaction, canceled your trip, and afterwards attempted to trade the money back to dollars right now.

The Ultimate Guide To Top 30 Forex Brokers

You do this when you believe the currency's value will fall in the future. If the money increases in value, you have to get it from the dealership at that cost.